Are you a Canadian contemplating the benefits and challenges of opening a United States bank account? Many Canadians wonder, Can Canadians open bank accounts in USA? This detailed guide explores everything you need to know, offering clear insights into the process, requirements, and popular banking options available to you. Whether you live near the border, work across the line, or frequently travel south, understanding how to manage your finances seamlessly between both countries is invaluable. Discover the essential documents, identify the best banks that cater to cross-border clients, and navigate the regulatory landscape with confidence. This article provides actionable steps and crucial information, ensuring you feel empowered to make informed decisions about your financial future in the U.S. Gain peace of mind by understanding the who, what, when, where, why, and how of U.S. banking for Canadians, helping you achieve greater financial flexibility and convenience.

Are you a Canadian wondering, Can Canadians open bank accounts in USA? The answer is a resounding yes, and understanding how, when, and why can significantly simplify your cross-border financial life. Many individuals, whether they work in the States, own property, frequently visit, or engage in U.S. dollar transactions, find immense value in having a U.S. bank account. This guide helps you navigate the practical steps, the necessary documents, and the best banking options available, ensuring you feel confident and prepared to establish your financial presence south of the border. We will explore who typically needs a U.S. account, what steps are involved, when you should consider opening one, where to find suitable banks, why it offers advantages, and how to successfully complete the process, transforming what might seem complex into a straightforward endeavor.

Unlocking Your US Banking Potential: Can Canadians Open Bank Accounts in USA?

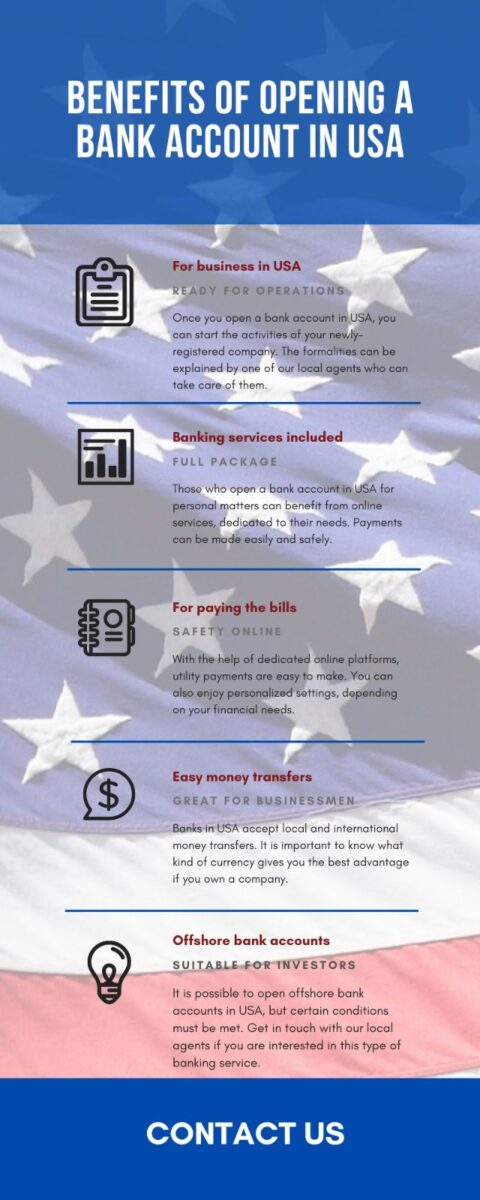

For many Canadians, the idea of managing finances in the United States might seem like a daunting task, but it is entirely achievable and often quite beneficial. Why do Canadians often look to open an account in the U.S.? The reasons are diverse: perhaps you frequently shop online from U.S. retailers, need to pay U.S. bills for a vacation property, receive payments in U.S. dollars, or even work south of the border for part of the year. Having a U.S. bank account eliminates currency conversion fees on every transaction, simplifies bill payments, and makes living or working in the U.S. far more convenient. When considering this move, think about your financial habits and where your money flows most often. If U.S. dollars feature prominently in your financial life, then exploring options to open an account becomes a powerful way to save money and gain control, transforming cross-border transactions from a hassle into a smooth process, giving you greater financial freedom and less transactional friction.

Navigating the Requirements: What Do Canadians Need to Open a Bank Account in USA?

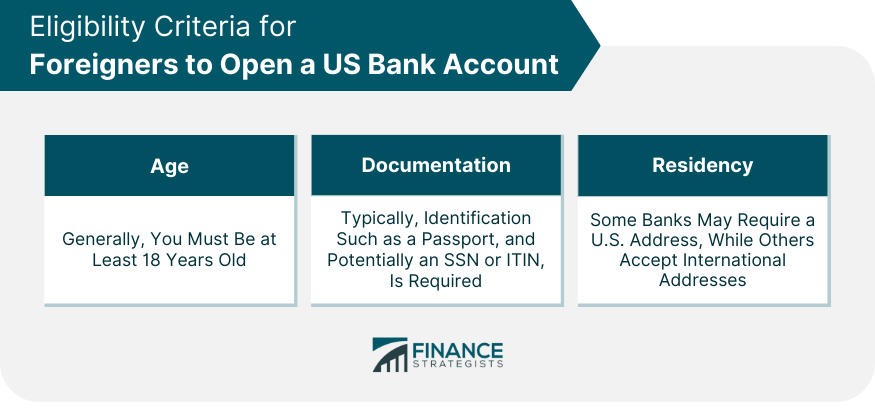

When Canadians decide to open a bank account in USA, they typically encounter a few key requirements, which banks establish to comply with regulations. What specific documents will you need, and how do you gather them? Generally, banks require proof of identity, such as a valid Canadian passport or a provincial drivers license. You will also need a secondary form of identification, which might include another government-issued ID. Critically, many U.S. banks also ask for a U.S. address. This does not always mean you must own property; sometimes a friends address or a P.O. box service can suffice, but always confirm with your chosen bank regarding their specific policy. Some institutions, particularly those with a strong cross-border presence, may be more flexible, but having a legitimate U.S. mailing address significantly streamlines the process. Furthermore, while an ITIN (Individual Taxpayer Identification Number) or SSN (Social Security Number) is not always mandatory for a basic checking account, some banks and certain account types do require it, so understanding this distinction is crucial for a smooth application process.

Choosing Your Cross-Border Partner: Where Can Canadians Open Bank Accounts in USA?

So, where should Canadians look when they want to open a bank account in USA? Several financial institutions actively cater to cross-border clients, making the process much smoother than attempting to open an account with a purely domestic U.S. bank. Two prominent examples include TD Bank, N.A. (the U.S. arm of TD Canada Trust) and RBC Bank (Georgia, N.A.), which is the U.S. subsidiary of Royal Bank of Canada. These banks are particularly adept at assisting Canadians because they understand the unique challenges and needs of non-resident clients. They often leverage your existing Canadian banking relationship to simplify the application, sometimes even allowing you to initiate the process from Canada before finalizing it in the U.S. Other major U.S. banks like Chase, Bank of America, or Wells Fargo might also open accounts for non-residents, but their requirements for a U.S. address or an ITIN can sometimes be stricter. Why choose a cross-border friendly bank? They speak your language, both literally and financially, offering products and services designed for people who live in one country and bank in another, creating a more welcoming and efficient experience.

The Process Unveiled: How to Successfully Open a US Bank Account as a Canadian

When you are ready to open a bank account in USA, what steps should you take to ensure a smooth application? First, research banks that specifically welcome non-residents or have strong cross-border programs. Collect all necessary identification: your valid Canadian passport, a second form of ID like a drivers license, and proof of your Canadian address. If you have a U.S. mailing address, gather proof of that as well. Next, contact your chosen bank; many allow you to start the application online or over the phone, especially if they are cross-border specialists like TD Bank or RBC Bank. You might need to schedule an in-person visit to a U.S. branch to finalize the account opening, particularly for identity verification purposes. What should you expect during this visit? Bank staff will review your documents, explain account features, and help you complete the paperwork. Be prepared to answer questions about why you need the account and how you plan to use it. This organized approach minimizes delays and makes the journey to U.S. banking a clear path, empowering you to manage your money with greater ease and confidence across the border.

Benefits Beyond the Border: Why Open a US Bank Account if You’re Canadian?

Why should a Canadian invest their time in opening a bank account in USA? The advantages extend far beyond simple convenience. Imagine purchasing items from U.S. websites without worrying about unfavorable exchange rates or foreign transaction fees tacked onto every purchase. Picture receiving payments in U.S. dollars, perhaps for freelance work or an inheritance, and depositing them directly without losing a percentage to currency conversion. For snowbirds or those with U.S. property, paying utility bills, property taxes, or contractors in local currency becomes effortless, avoiding the constant fluctuations of the exchange market. A U.S. account also provides a local debit card, accepted everywhere in the States without international card issues, and can facilitate easier access to U.S. credit products, helping you build a credit history south of the border if needed. These benefits collectively translate into significant financial savings and a smoother, more integrated financial life for any Canadian who frequently interacts with the U.S. economy, empowering them with better financial control.

Key Information for Canadians Opening a US Bank Account

| Requirement | Details for Canadians | Common Challenges |

|---|---|---|

| Proof of Identity | Valid Canadian Passport, Provincial Drivers License | Ensuring documents are current and match names exactly. |

| Proof of Address (U.S.) | U.S. utility bill, lease, property tax statement, sometimes a friends address or P.O. box (confirm with bank) | Many Canadians lack a direct U.S. residential address. |

| Proof of Address (Canadian) | Canadian utility bill, bank statement, or drivers license | Needed by cross-border banks to link Canadian identity. |

| Social Security Number (SSN) / Individual Taxpayer Identification Number (ITIN) | Often not required for basic checking/savings, but needed for interest-bearing accounts or specific credit products. | Obtaining an ITIN can be a lengthy process; SSN requires work authorization. |

| Initial Deposit | Varies by bank, typically $25-$100 USD. | Ensuring funds are readily available in USD or convertible. |

| Cross-Border Bank Relationship | TD Bank, RBC Bank (USA) often simplify the process by leveraging existing Canadian accounts. | Smaller or purely U.S. domestic banks may have stricter policies. |

Empowering Your Finances: Can Canadians Open Bank Accounts in USA for Future Growth?

Looking ahead, can Canadians open bank accounts in USA not just for convenience but also for future financial growth and security? Absolutely. Establishing a U.S. bank account today can pave the way for numerous future opportunities. Perhaps you envision investing in the U.S. stock market, purchasing a second home, or even moving to the U.S. permanently. A foundational banking relationship simplifies all these endeavors. When you have a local account, receiving income, making investments, and managing expenses become much more streamlined, allowing you to react quickly to financial opportunities without the friction of international transfers or currency conversions. It builds a financial bridge, connecting your Canadian financial life with U.S. possibilities. This proactive step truly empowers you to expand your financial horizons, ensuring that when the right moment arrives, your U.S. banking infrastructure is already in place, ready to support your ambitions and make your financial aspirations a tangible reality, giving you robust control over your cross-border finances.

Summary Question and Answer: Can Canadians easily open a US bank account?

Yes, Canadians can certainly open a U.S. bank account, particularly with banks that cater to cross-border clients like TD Bank or RBC Bank, usually requiring identification and a U.S. mailing address.Keywords: can canadians open bank account in usa, canadian open us bank account, us bank account for canadians, cross border banking canada usa, how to open us bank account canadian, canadian banking in usa, td bank usa for canadians, rbc bank usa for canadians, us dollar account for canadians, banking for snowbirdsCanadians can open bank accounts in the USA, often requiring a U.S. address, identification, and sometimes an ITIN; specific banks offer cross-border solutions, simplifying the process for Canadian residents.

Cross Border Banking Bundle For Canadians Studying In The U S RBC Bank Direct Checking Opening US Bank Accounts For Canadians Frugal Flyer Best Bank Accounts In Canada Piggy Bank Featured Image Getting A Canadian Bank Account From Abroad 1st Move Blog Bank Account Smarter Canada Facebook Pinterest Instagram Social Banners 1200x900 Px 2 1024x768

How To Open A US Bank Account Overseas As A Non USA Citizen Usa Bank Infographic Preview Can Canadian Open Bank Account In USA YouTube We Can Open Bank Account In Canada On Visit Visa TDBankUS YouTube Open A Bank Account In USA Updated Guide For 2025 Bank Account Usa

How To Get A US Credit Card In Canada Hardbacon 768x239 How To Open A US Bank Account As A Non Resident 2022 Inventiva Bank Account Usa Header Open Bank Account In Canada For Non Resident What You Need To Cover Open Bank Account In Canada For Non Resident What You Need To Cover 750x500 1677644099 How To Open A Bank Account In Canada 2025 Complete Guide For Newcomers

How Foreigners Can Open Bank Accounts In The US Common Challenges And Solutions For Foreigners Opening A US Bank Account How To Open A Bank Account In The USA Simple Steps FAQs How To Open A Bank Account In The USA Simple Steps FAQs How To Open A Bank Account In Canada As An Student Canam 1698214450 How To Open A Bank Account In Canada As An Student .webpOpening Bank Account In Canada For Non Residents 2025 GIC How To Open A Bank Account In Canada - 4 Easy Steps 1 823x1024 Png.webp

Open A Bank Account In USA Updated Guide For 2024 How To Open A Bank Account In Canada Documents Process Mortgage How Foreigners Can Open Bank Accounts In The US Eligibility Criteria For Foreigners To Open A US Bank Account Can Foreigners Open Bank Account In Canada 2 Documents You Must Need Can Foreigners Open Bank Account In Canada.webp

Open A Bank Account In USA Updated Guide For 2025 WhatsApp Image 2023 05 23 At 14.48.49 480x1200 Canada S Minimum Wage Updates For 2025 Get In Canada How To Open A Bank Account In Canada Easily A Newcomers Guide 1 1024x717 Png.webpCan A US Citizen Open A Bank Account In Canada Here S How Open A Canadian Bank Account From The USA Featured Image 6 Quick And Easy Steps To Open A Bank Account In The US Cluster 1 Featured Image

Can A US Citizen Open A Bank Account In Canada Here S How Open An Online Bank Account In Canada Opening A Bank Account In Canada 2025 4 Easy Steps Opening A Bank Account In Canada HOW TO OPEN BANK ACCOUNT IN CANADA ON VISITOR VISA 2025 YouTube Own A Bank Account In Canada As An Immigrant Open An Account Now Open A Bank Account In Canada As An Immigrant

How To Open A Canadian Bank Account From The USA Online Free 2025 Bank Account In Canada How To Open Bank Account In Canada Bank Account In Canada Plus 400 How To Open A Bank Account In Canada For Non Resident 2022 4 Simple How To Open A Bank Account In Canada For Non Resident How To Open A Bank Account In Canada How To Open Bank Account In Canada